Table Of Content

At the time—before the 2022 hurricane season—Jennifer Pintacuda, president of AAA’s Florida-based insurance companies, spoke of insurance coverage problems in Florida. The state is additionally looking to reduce the size of the state’s last resort home insurer, Citizens Property Insurance. The insurance company has grown to 1.3 million policyholders this year because of the industry’s instability in Florida.

What’s Not Covered by Florida Homeowners Insurance?

For example, on a home insured for $300,000 in dwelling coverage, the windstorm deductible could be $2,500, $5,000, $12,500 or $25,000. MoneyGeek analyzed homeowners insurance quotes from the top insurance companies in Florida provided in partnership with Quadrant. Quotes were gathered with an average home profile of 2,500 square feet, built in 2000, with an average dwelling coverage value of $250,000, liability coverage of $100,000 and personal property coverage of $100,000.

Compare home insurance rates

MoneyGeek examined the unique discounts and coverage options that Citizens and Chubb offer in Florida to find out why they scored highest in terms of service and customer satisfaction. Citizens Property Insurance Corp., the state’s property insurer of last resort, is another option for homeowners who can't find good Florida home insurance coverage. Hurricanes are a major risk and a large part of why the average home insurance cost in Florida is so high.

Compare homeowners insurance rates with other states

With insurance companies limiting their coverage or leaving Florida, it can be difficult to track which insurance options are (and aren't) available. To help Florida homeowners navigate this complex situation, we put together a roundup of the latest and most pressing insurance news from across the state. Get Forbes Advisor’s ratings of the best insurance companies and helpful information on how to find the best travel, auto, home, health, life, pet, and small business coverage for your needs. “Nationally, about 5% to 7% of homeowners don’t have property insurance. However, we strongly recommend against this, since Florida is so vulnerable to severe weather events like hurricanes and catastrophic property losses,” says Friedlander.

Best Homeowners Insurance In Florida 2024

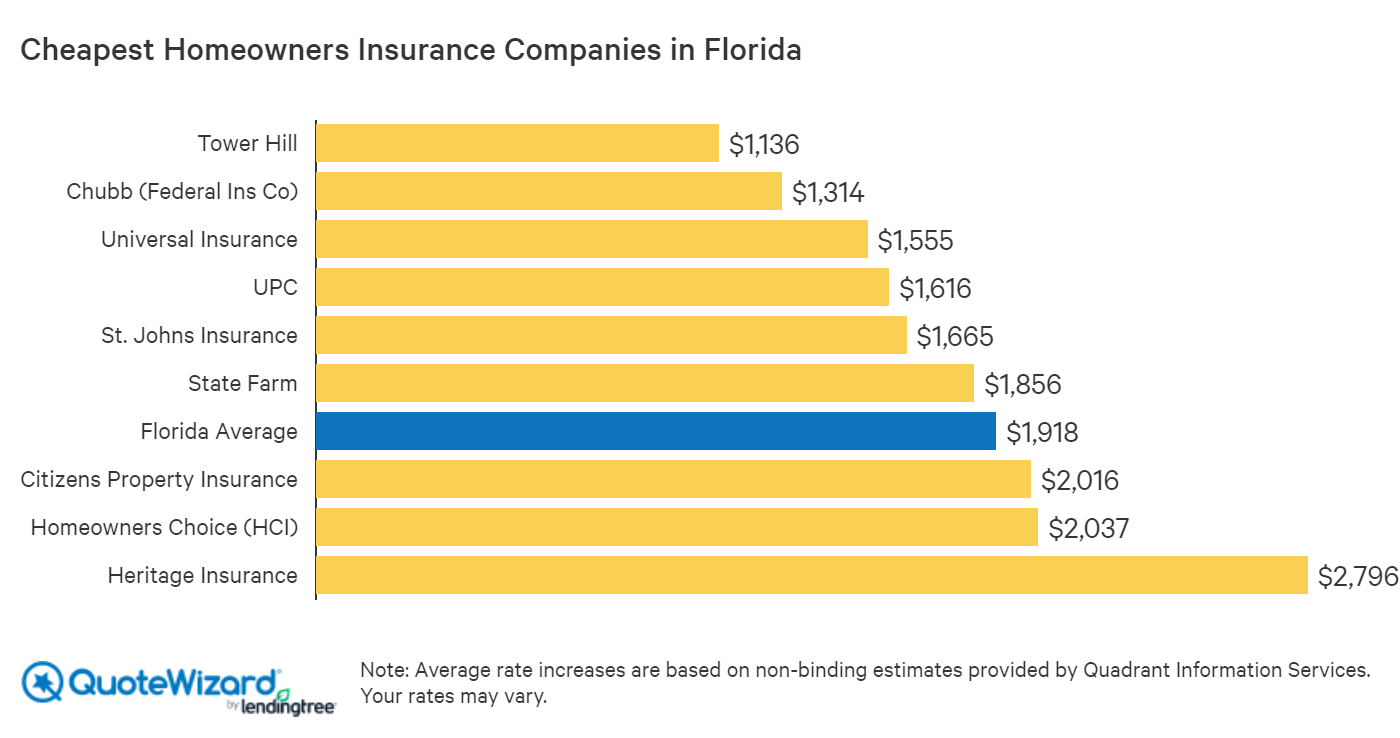

The My Safe Florida Home program is designed to help homeowners mitigate hurricane risk by providing free home inspections that identify and recommend improvements that can be done to your home. Eligible homeowners who live in participating areas of Florida can then apply for grants to get their homes retrofitted with these improvements to lessen the risk of hurricane damage. Based on our analysis, Security First, Tower Hill, and State Farm are the three cheapest home insurance companies in Florida, with statewide average premiums ranging from $721 to $2,227 per year. Universal Property and Florida Penninsula Insurance are also among the most affordable home insurance carrier options for Florida residents in 2024, as detailed in the table below.

Citizens Insurance flood insurance requirements in Florida

Florida has a Hurricane Loss Mitigation Program and My Safe Florida Home, which help you minimize damage to your home from hurricanes. If you take the proper steps to fortify your home against hurricane damage, you may be eligible for a grant and could save on home insurance. Hurricanes have added fuel to the fire, with estimated insured losses from Hurricane Ian totaling $60 billion. The combination of these factors has made the Florida market difficult for homeowners to find home insurance, in terms of both options and cost, said Friedlander. Ensure that your potential insurer has a strong financial strength rating before making your decision.

Is hurricane insurance included?

4 Best Homeowners Insurance Companies in Boca Raton (2024) - MarketWatch

4 Best Homeowners Insurance Companies in Boca Raton ( .

Posted: Mon, 22 Apr 2024 07:00:00 GMT [source]

Finding the best homeowners insurance can be a challenge, especially in Florida’s turbulent property insurance market. Power and financial strength ratings from AM Best to reveal the best home insurance companies in Florida for 2024. Earlier this year, the legislature held another special session focused on home insurance. USAA’s high customer service rating is thanks to its coverage and discount offers. Included in its policies at no additional cost is the Contents Replacement Cost coverage, which can pay for the loss of personal belongings at its most recent replacement cost and no depreciation.

For an idea of what your costs might be based on where you live in Florida, check out our guides. We’ve built an in-house rating engine that uses data from our insurance partners and allows us to provide you with accurate quotes. Mortgage lenders require customers to take out insurance policies in case the home is damaged prior to the loan being paid off. With the annual threat of hurricanes in Florida, it’s understandable that lenders want to protect their assets. In the event of damage on your property due to a sinkhole, the Department of Financial Services offers the Neutral Evaluation program to assist with settling your claim. The Neutral Evaluation program provides a professional engineeror a professional geologist to serve as an objective third partyto determine the existence of a sinkhole loss and the method ofrepair and remediation.

Homeowners insurance protects your financial interests if your home is damaged or destroyed by a covered peril. A peril is something that causes or may cause injury, loss, or destruction, such as a fire, tornado, or hurricane. Though homeowners insurance isn’t mandated at the state level, nearly all mortgage providers want proof of insurance.

Homeowners' insurance typically covers the dwelling including attached structures, certain unattached structures and your personal property. Additional Living Expense (ALE) and coverage for Liability is also normally included. There are many different types of homeowners insurance policies available. Normally, the type of policy coincides with the type of structure to be insured and how the structure is occupied. Technically, there’s no such thing as hurricane insurance, but your Kin policy does cover wind damage caused by hurricanes. It will also have a hurricane deductible that applies when you make a claim for losses caused by hurricane winds.

This seems like a bargain, but if the hurricane deductible isn't selected, hurricane damage to your home likely isn't covered. Make sure you read the fine print so you don't find yourself without coverage. Travelers is the cheapest home insurance company among those surveyed by Insurance.com.

These descriptions do not refer to any specific contract of insurance and they do not modify any definitions, exclusions or any other provision expressly stated in any contracts of insurance. We encourage you to speak to your insurance representative and to read your policy contract to fully understand your coverages. Learn more about the home insurance requirements in Florida and see how much you could save with a free homeowners insurance quote that fits your budget. Helpful bicycle insurance agents, who can assist you in servicing your policy, are just a phone call away.

That is why it’s important to compare offers from multiple insurers to find the best policy for you. Tower Hill and State Farm offer the most affordable home insurance in Florida. For a home insurance policy with $350,000 in dwelling coverage you may pay an average of $1,143 per year with Tower Hill or $1,142 per year with State Farm, according to our analysis of rates.

Another big factor in Florida is the large number of lawsuits filed against insurance companies. Florida home insurance policies follow the same standards as other states for basic coverage, although each company may add additional coverage or offer different endorsements. So, to make shopping for homeowners insurance in Florida easier, we’ve gathered everything you need to know in one place.

Slide Insurance is taking 25,000 Citizens policyholders, American Integrity is getting 19,000 policies and Security First is picking up 10,000. The policies are slated to get transferred to the private insurance companies in May. Roofing contractors are aggressive in contacting Florida homeowners who may—or may not—have actual roof damage. They can be so aggressive that they put flyers on every doorknob in many neighborhoods, while offering $500 gift cards.

The department’s final rule, which will go into effect on July 1, 2024, will increase the standard salary level that helps define and delimit which salaried workers are entitled to overtime pay protections under the FLSA. One of the basic principles of the American workplace is that a hard day’s work deserves a fair day’s pay. A cornerstone of that promise is the Fair Labor Standards Act’s (FLSA) requirement that when most workers work more than 40 hours in a week, they get paid more. The Department of Labor’s new overtime regulation is restoring and extending this promise for millions more lower-paid salaried workers in the U.S. Allstate and other Florida insurers can take a 20% haircut off of even reduced-cost medical treatment for injured drivers, the Florida Supreme Court ruled Thursday, answering a certified question from the Eleventh Circuit. That means that prices are more negotiable in parts of Florida, especially if they’ve been sitting on the market for at least 180 days, Sykes says.

No comments:

Post a Comment